An Introduction to Barrier Options — Closed Form Solution and a Monte Carlo Approach | Semantic Scholar

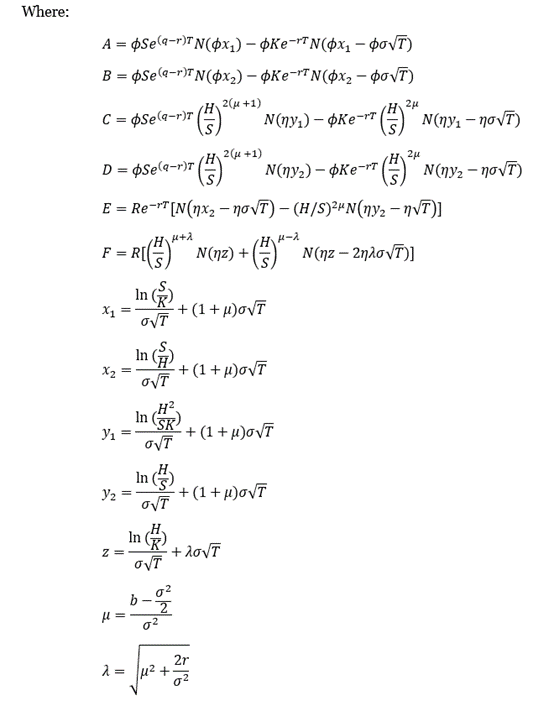

programming - Pricing Knock Out Barrier Options by solving Black Scholes PDE (MATLAB) - Quantitative Finance Stack Exchange

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

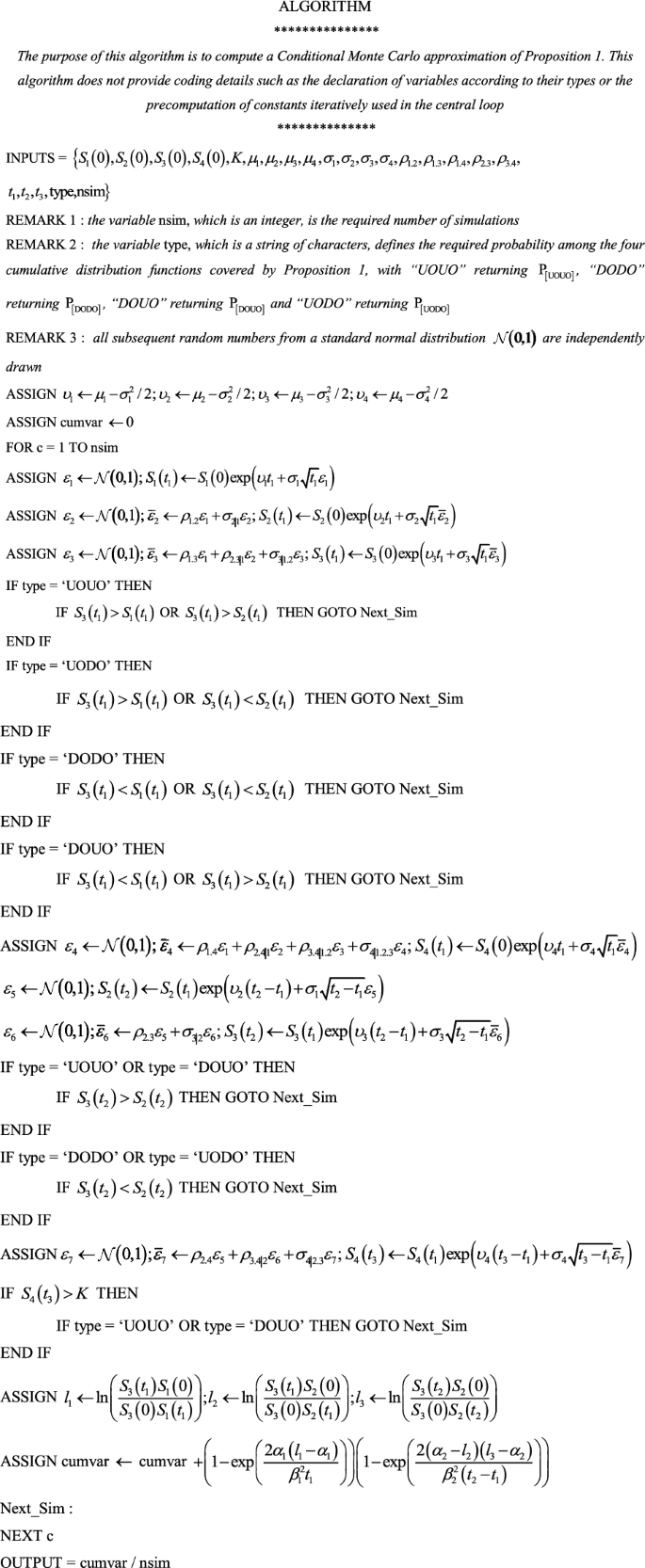

Closed-Form Approximate Solutions of Window Barrier Options with Term-Structure Volatility and Interest Rates Using the Boundary

Analytically pricing double barrier options based on a time-fractional Black–Scholes equation - ScienceDirect

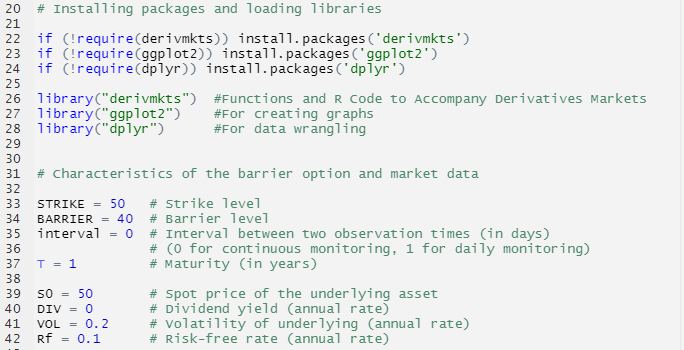

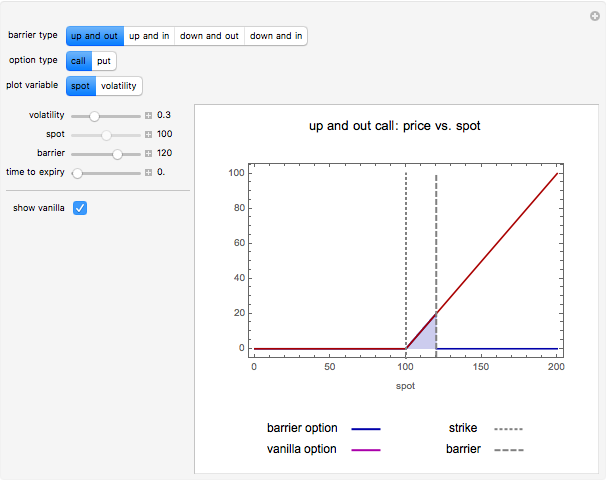

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

The modified barrier for the knockout option of Figure 6. Stock prices... | Download Scientific Diagram

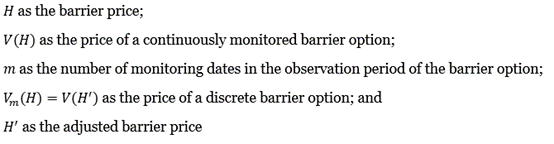

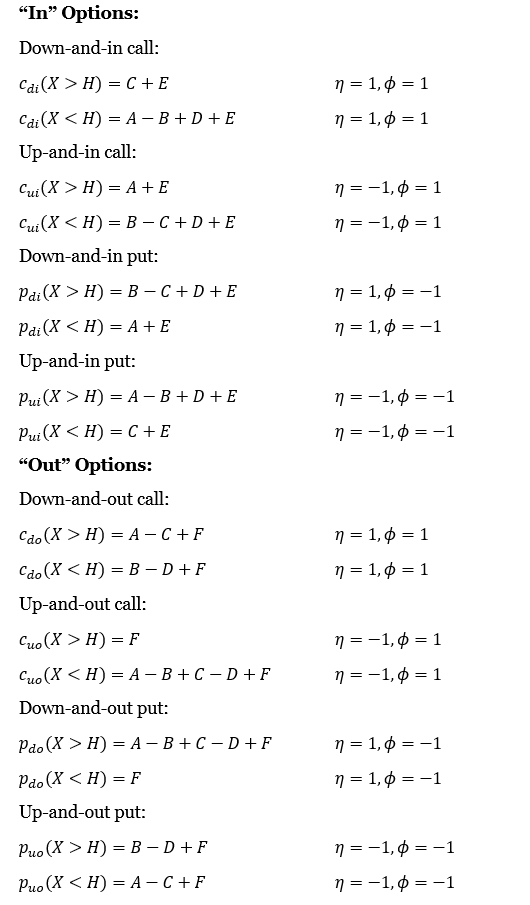

barrier - Valuation Down-And-Out Put Option via Rubinstein Closed-Form Solution - Quantitative Finance Stack Exchange

arXiv:1302.3306v1 [q-fin.CP] 14 Feb 2013 An Asymptotic Expansion Formula for Up-and-Out Barrier Option Price under Stochastic